The GovCon Bulletin™

BOIR Alert: Texas District Court Issues Preliminary Injunction Against Enforcement of CTA

On December 3, 2024, the U.S. District Court for the Eastern District of Texas issued a nationwide preliminary injunction against enforcement of the Corporate Transparency Act (CTA).

On December 3, 2024, the U.S. District Court for the Eastern District of Texas issued a nationwide preliminary injunction against enforcement of the Corporate Transparency Act (CTA).

As we discussed in our recent article, the CTA requires certain domestic and foreign entities that do business in the U.S. to report information about their beneficial owners to the U.S. Department of Treasury’s Financial Crimes Enforcement Network (FinCEN) in a Beneficial Ownership Information Report (BOIR). Companies in existence before January 1, 2024, are required to file their initial reports by January 1, 2025. As it now stands, however, as a result of the Texas court’s decision, the BOIR reporting requirements under the CTA cannot be enforced while the preliminary injunction is pending.

The U.S. government has 60 days to appeal the Texas district court decision to a federal appeals court. The government also may request a stay of the Texas district court’s preliminary injunction while any appeal is pending. If such a stay were granted - and absent any extension by FinCEN in light of the district court’s ruling - all of the deadlines under the CTA, including the BOIR initial filing deadline, would become effective.

Companies that have already met the initial filing deadline and filed their BOIR’s should, nevertheless, remain alert since the CTA imposes obligations to submit additional BOIR’s when beneficial ownership information changes. The preliminary injunction, at this point, precludes enforcement of the requirements to submit updated BOIR’s, but the obligations could become effective again if an appeals court or a Supreme Court decision upholds the CTA requirements.

Companies that have not yet submitted their initial BOIR’s also should monitor developments closely and be prepared to submit any required initial BOIR’s by January 1, 2025, in the event that the preliminary injunction is lifted on appeal before then without any extension of the filing deadline by FinCEN.

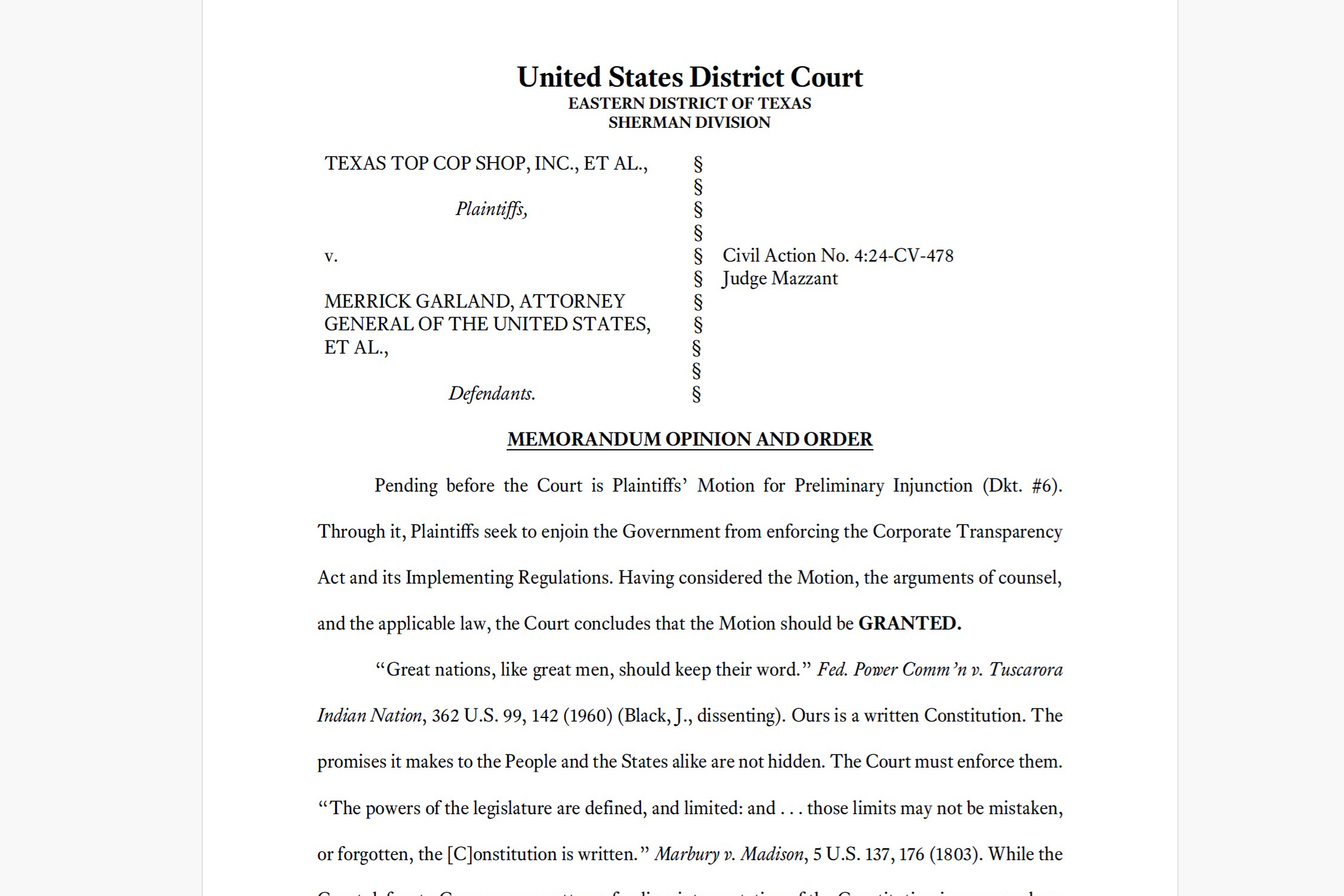

You can read the Texas district court decision here.